“Debt” is an unpleasant word, evoking an obligation that people can feel hangs over them. Given that, it would be no surprise if mass cancellation of federal student loans, as President Biden declared last week, had intuitive appeal to many people. Indeed, new polling from Cato’s Project on Public Opinion reveals just such support. But it also reveals something else: When presented with potential downsides of mass cancellation, especially its quite possible effect on infamously high college prices, sentiment flips from major support to major opposition.

The basic premise in the new survey is a bit different from what Biden ended up announcing, asking about “forgiveness” for individuals making less than $150,000 and households less than $300,000, rather than the $125,000 and $250,000 in the final plan. Also, the administration added $20,000 of cancellation for loans held by people who also received Pell Grants, moving more of the benefit to lower‐income borrowers than higher. But it was still mass cancellation.

As seen below, presenting student debt forgiveness by itself generates lopsided support, with approval outpacing disapproval 64 to 36 percent.

That is big. But introduce tradeoffs, and support turns upside down.

Most striking, when respondents are presented with cancellation adding more fuel to the college tuition skyrocket, the results change to a staggering 3‑to‑1 against.

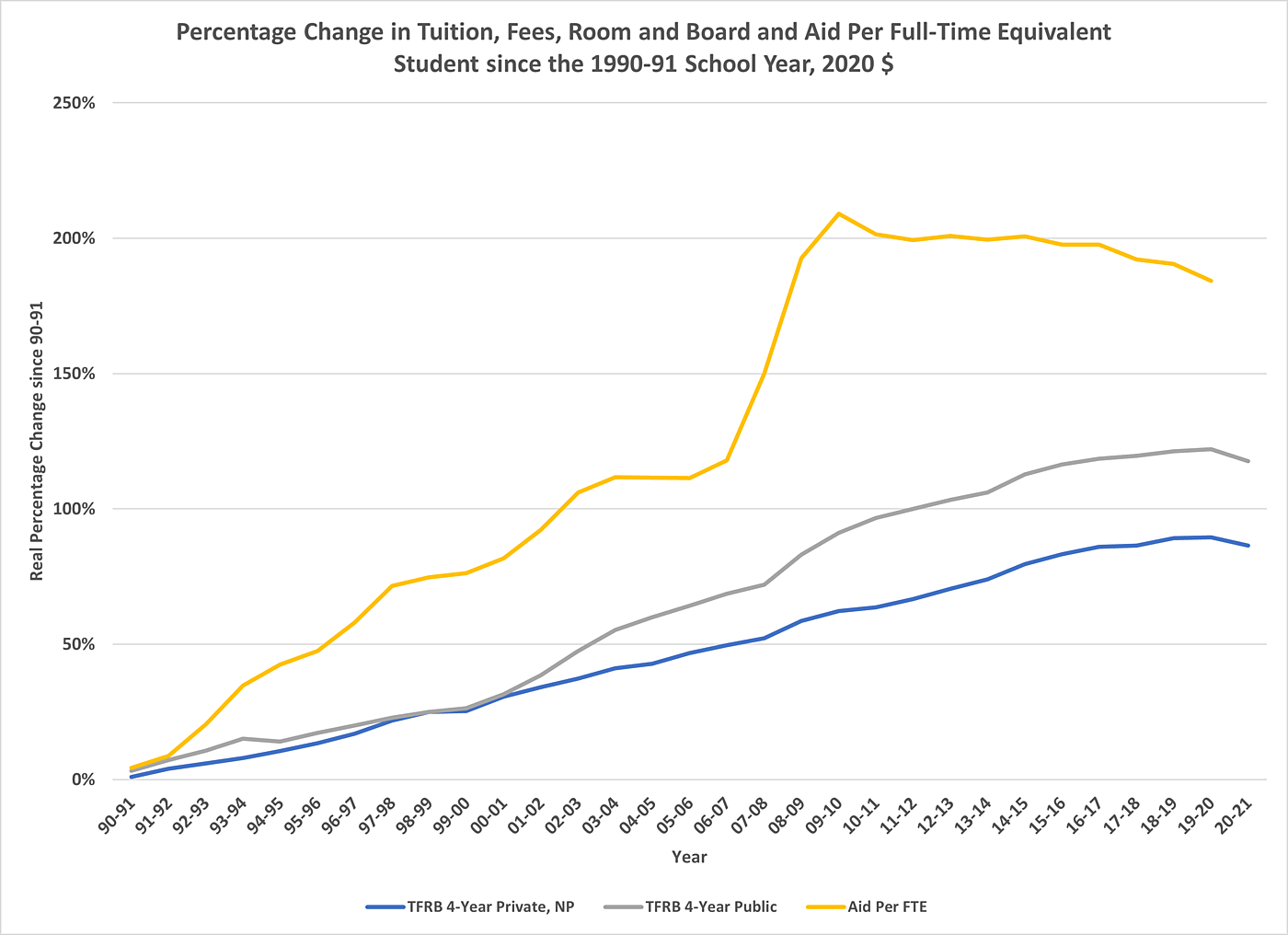

That danger is real. As you can see in the chart below, aid and price have grown together, with the aid almost certainly enabling colleges to raise their prices at rates far exceeding normal inflation. Basically, give people more money to pay for something and the price of that thing rises.

This is hard to prove empirically because colleges’ costs are directly tied to the money they spend, so it is plausible their costs rise independently of aid. That said, many studies have found an inflationary effect, including one from the Federal Reserve Bank of New York that found that for every dollar increase in “subsidized” student loans colleges raised their prices 60 cents. Frankly, statistical research is not necessary to see this. One need only ask oneself, could colleges charge what they currently do, and have their current enrollment, without the aid that is nearly ubiquitous? Of course not.

The logic and evidence of aid fueling higher prices applies to mass debt cancellation. With the precedent set that debt will be cancelled whenever a president deems it too burdensome, both colleges and students can reasonably expect generous forgiveness in the future. That could encourage schools to raise prices even higher because students will see a good chance they’ll never have to fully repay.

Presentation of other costs also flips majority support to majority opposition.

As shown in the first graphic, when respondents were asked if they would back mass forgiveness that resulted in their taxes rising, 64 to 36 percent support flipped to 64 to 36 percent opposition. And Biden’s plan may well necessitate higher taxes, with cancellation expected to cost in the vicinity of $500 billion and the federal government not exactly flush with cash.

Another major problem with federal aid is that it has artificially pushed enrollment, driving a credential glut that has made having a bachelor’s degree increasingly necessary to get jobs that previously did not require one. Researchers with the Harvard Business School have found some gigantic gaps between the share of want ads calling for degrees and the share of people currently in the positions holding them, including a shocking 67 percent of job postings for supervisors of production workers calling for a bachelor’s but only 16 percent of current occupants possessing one.

Basically, one has to spend more and more time in school just to stay in one place in the labor market.

Present folks with the “credential inflation” problem, which the constant prospect of future forgiveness could well worsen, and only 29 percent support cancellation, versus 71 percent opposing.

Student debt cancellation sounds great in the abstract. But contemplate very possible downsides and the bloom falls off the rose.